Running a SaaS business is like juggling flaming torches while binge-watching your favorite show, you're crazy busy! Just when you think you've got it all, bookkeeping, compliance tasks, and tax season crash the party. No worries! I can feel you, and I've researched if AI can tackle SaaS bookkeeping headaches, letting us save time, stay compliant, and focus on growing our awesome business. Because seriously, we've got better things to do than wrestle with numbers!

There are top 3 challenges when it comes to managing the finances of SaaS.

1. Bookkeeping and Accounting Madness

- The Pain: Balancing invoices, expenses, and financial reports can turn your desk into a paper jungle (even if you're mostly digital).

- Why It Matters: Messy books can lead to cash flow chaos and unexpected tax nightmares, distracting your focus from building awesome features.

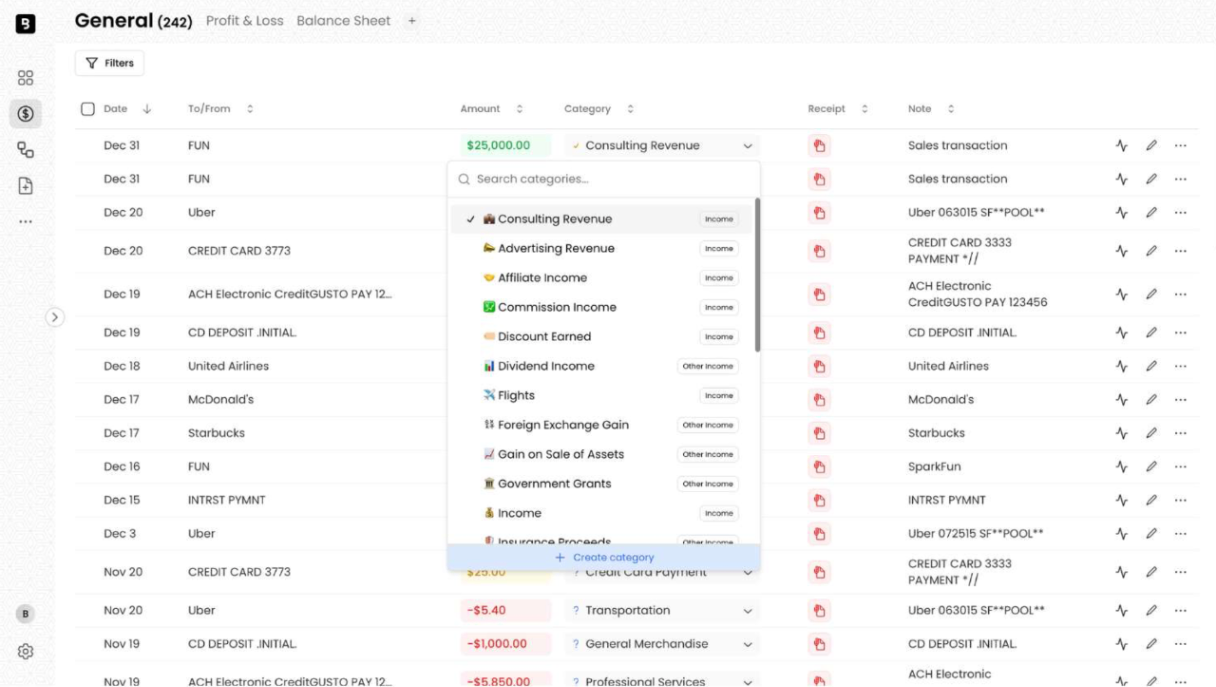

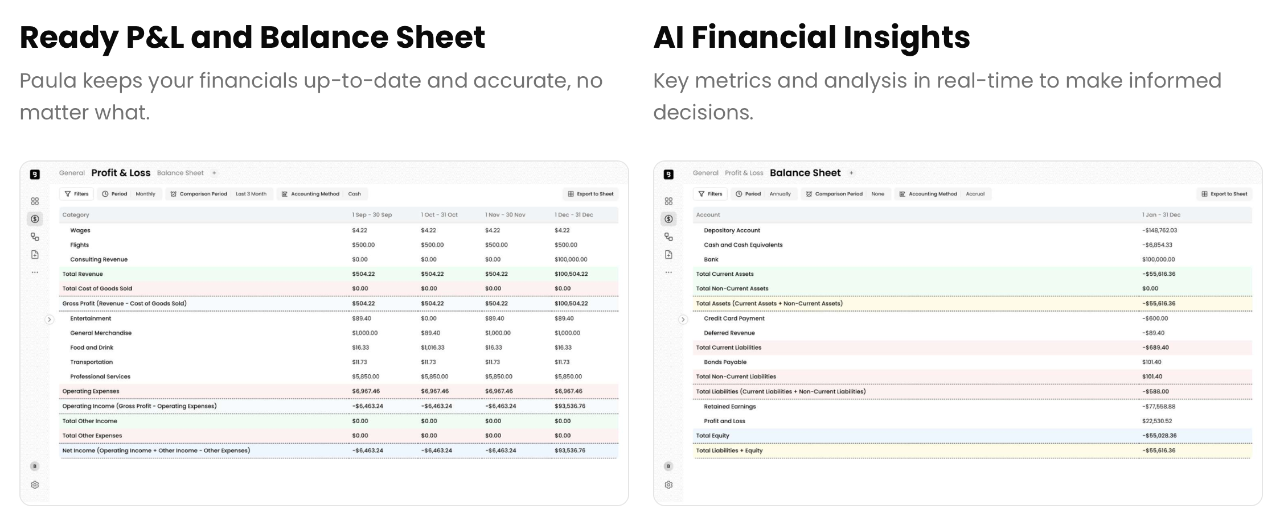

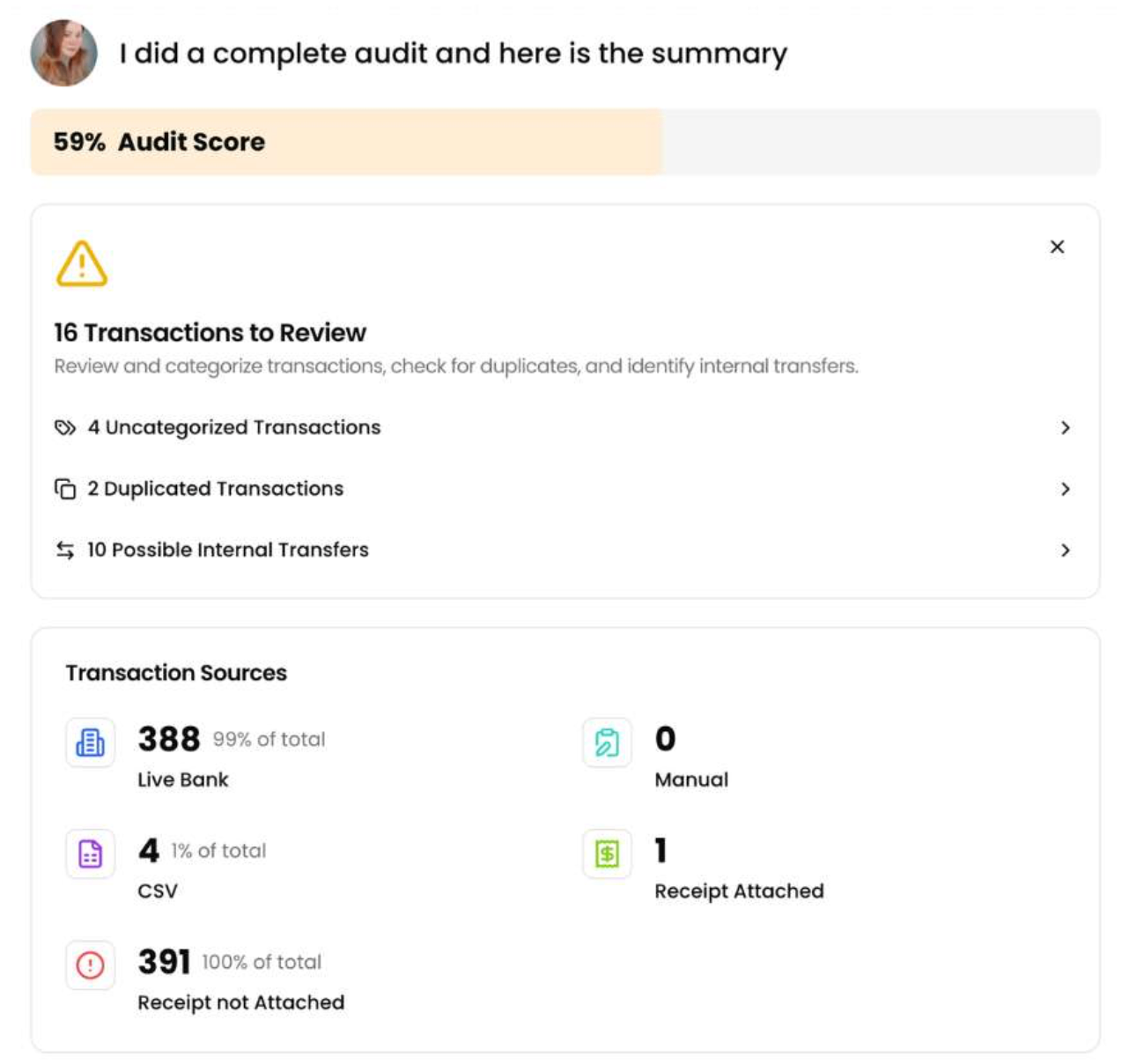

- Solution: Meet Paula AI Accountant! She pulls new transactions, categorizes them, fetches receipts from your connected email, and matches everything while keeping your Profit and Loss statements and Balance Sheets up-to-date and accurate. Plus, she sends you weekly reports so you're always in the loop.

- Not Ideal Solutions: QuickBooks is a last-decade software that complicates things by design, forcing you to rely on expensive experts who end up getting locked in.

2. Managing Cash Flow Like a Tightrope Walker

- The Pain: Predicting income and expenses in a subscription-based model is tricky. One unexpected server fee and you're wobbling.

- Why It Matters: Keeping enough cash on hand is crucial for paying salaries, marketing, and those pesky operational costs without diving into debt.

- Solution: Paula AI Accountant provides real-time cash flow forecasting by analyzing your subscription data and upcoming expenses. She alerts you to potential cash flow gaps and offers insights to optimize your spending, ensuring you stay balanced on that financial tightrope.

- Not Ideal Solutions: Traditional spreadsheets are prone to errors and require constant manual updates, making it easy to miss critical cash flow issues until it's too late.

3. Staying Compliant Without Losing Your Mind

- The Pain: Navigating through tax laws, data protection regulations (hello GDPR), and industry-specific rules is like decoding a secret language.

- Why It Matters: Non-compliance can lead to hefty fines and legal troubles, derailing your startup dreams faster than a bug in your code.

- Solution: Bookkeeping.ai's Paula automatically detects contractors and pre-fills necessary forms for the United States and Canada, like 1099, W-BEN, or T4, then sends them to users for approval. This ensures you stay compliant with minimal effort. AI taxes can help take care of the paperwork!

- Not Ideal Solutions: Manual compliance processes are time-consuming and increase the risk of errors, while traditional software often lacks the automation needed to keep up with changing regulations.

Key Benefits for SaaS Founders:

- Automate repetitive tasks and focus on strategic growth.

- Stay on top of global tax regulations with the proper compliance.

- Adapt to growing transaction volumes and complex financial needs.

- Use real-time reporting and AI-driven insights to make data-driven decisions.

Bookeeping.ai has the tools to solve your problems whether you're struggling with recurring revenue tracking, SaaS tax compliance, scalability, or time-consuming manual tasks.

Ready to focus on growth and optimize bookkeeping with a SaaS-specific accounting tool? Try bookeeping.ai today and see how easy and affordable accountancy gets.