This article shares a Quickbooks AI Alternative to help with your business or freelance accounting and administration. Learn more about the ultimate AI bookkeeping tools you can use as an option.

It is 2025, and you're already using many AI tools to grow your business. What about bookkeeping and accountancy?

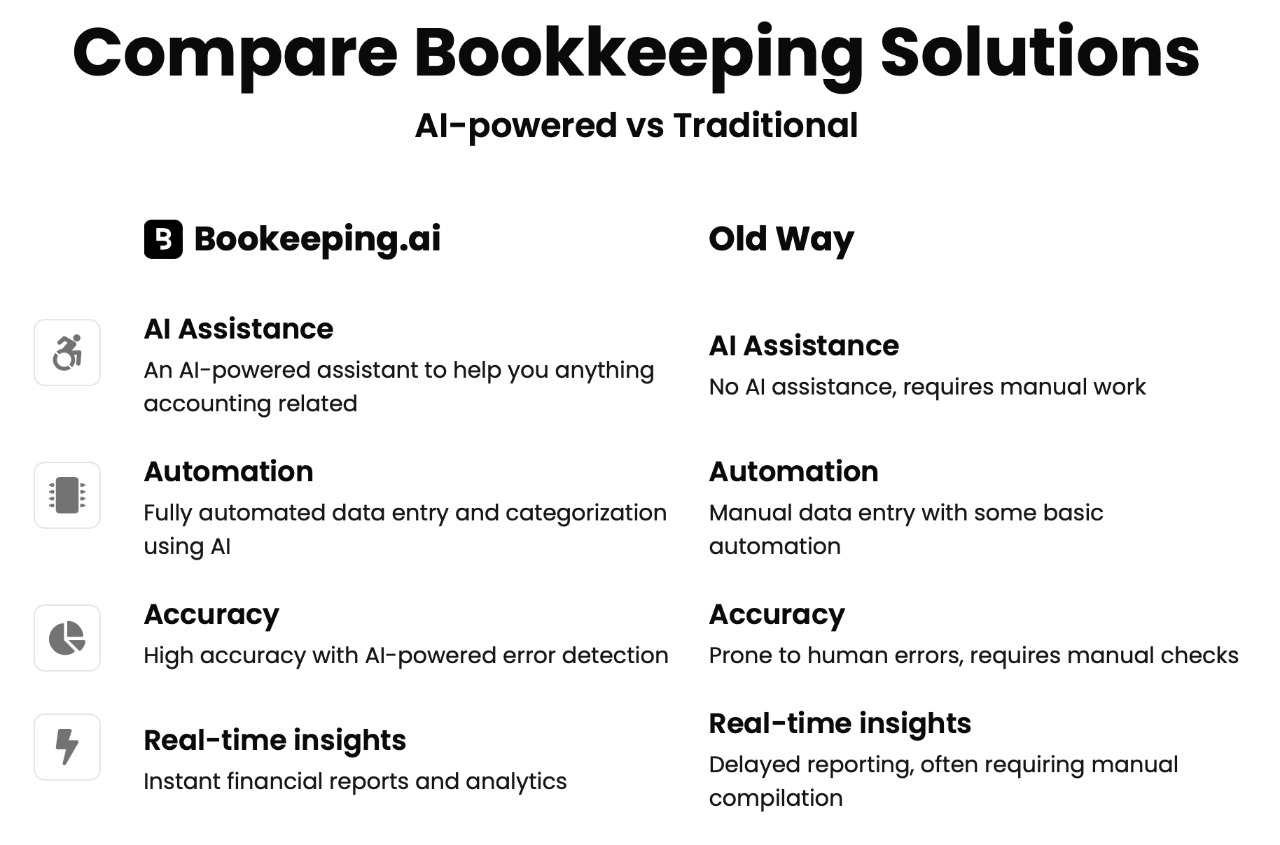

Managing finances is essential for success and compliance. BUT, traditional bookkeeping methods are time-consuming and prone to errors, and digital solutions like QuickBooks can be difficult to learn, requiring extra time to identify each function and how to get results.

Today, we show you an AI bookkeeping solution for your projects. 😍

Bookeeping.ai is an innovative tool for bookkeeping, making it accessible to businesses of all sizes looking for an automated QuickBooks alternative.

Quickbooks AI Alternative: Bookeeping.ai

At its core, Bookeeping.ai is an AI tool that automates many tedious tasks associated with traditional bookkeeping. It goes beyond simple data entry and calculations because it allows chatting with your books and AI Paula accounting assistant. She can interpret financial data, categorize transactions, and even provide insights to help grow your business.

Who is bookeeping.ai for? Anyone, but especially accountants, bookkeepers, freelancers, and business owners.

This AI accounting solution is particularly well-suited for small businesses and solopreneurs who may not have the resources for a full-time accounting department. Its user-friendly interface and AI features make it accessible even to those without extensive accounting knowledge.

For growing businesses, it offers scalability and the ability to handle increasing financial complexity without a proportional increase in time or resources.

Bookeeping.ai vs. QuickBooks

While QuickBooks has long been in the small business accounting world, bookeeping.ai offers a fresh, AI approach that handles many of the pain points associated with traditional accounting software, not just old-school manual bookkeeping.

What is the difference between bookeeping.ai and QuickBooks?

📊 Automated Ledger Creation

- QuickBooks: Automates ledger entries but requires manual categorization for some transactions.

- Bookeeping.ai: Fully automates ledger creation and categorization using AI

🧾 Receipt Categorization

- QuickBooks: Manual categorization with OCR tools to scan receipts.

- Bookeeping.ai: Automatically scans and categorizes receipts via mobile app or email.

💵 Real-Time Accounting

- QuickBooks: Tracks finances with bank feed integration for real-time updates.

- Bookeeping.ai: Besides bank integration, it offers actionable insights recognized by technology.

📄 Invoice Generation & Automation

- QuickBooks: Manual invoice creation with recurring invoice automation

- Bookeeping.ai: Auto-generates and sends recurring invoices

💬 Chat with Financial Data

- QuickBooks: No interactive chat for financial queries.

- Bookeeping.ai: Allows users to chat directly with financial data for insights and recommendations.

🤖 Automatic Financial Advice

- QuickBooks: Basic financial reporting without AI advice.

- Bookeeping.ai: Provides personalized advice from AI.

⬇️ Data Import from Other Tools

- QuickBooks: Integrates with other tools like banks and payment systems.

- Bookeeping.ai: Automatically imports and categorizes data from multiple sources (QuickBooks, Xero, etc.).

📁 AI Document & Storage

- QuickBooks: Basic document storage with cloud integration.

- Bookeeping.ai: AI document creation and management, with direct updates from financial data.

🏦 Automated Financial Workflows

- QuickBooks: Automates tasks like recurring billing and reminders.

- Bookeeping.ai: Fully automates all financial workflows, including invoicing and reporting.

What can Bookeeping.ai do extra for you?

- Replace QuickBooks, Xero, Zoho Books, Expensify, Zapier, Google Drive, Dropbox, and other tools.

- Chat with your AI assistant for real-time, personalized financial insights and advice.

- Automatically create and update documents and manage them via AI.

In summary, while QuickBooks remains a solid traditional option, Bookeeping.ai represents the next generation of bookkeeping software, using AI to offer a more intuitive, efficient, and insightful financial management experience.

In the end, the best AI accounting software must support all your needs and help your business grow.

Why is it important to have bookkeeping software?

Recording every transaction by hand is life-consuming and boring. It will waste your precious youth and likely have human errors. 😭🙏

Traditional accounting methods involve meticulously recording every transaction by hand, wasting time and likely having human errors. Accountants and business owners spent innumerable hours reconciling accounts, categorizing expenses, and preparing financial statements.

Now, AI is not just about efficiency. It's about moving from financial data to a strategic investment for businesses of all sizes.

Photo: Joseph Frank @ Unsplash

How to Get Started with Bookeeping.ai

Getting started with bookeeping.ai is straightforward and accessible for businesses of all sizes.

For those interested in testing the waters before committing, bookeeping.ai has a 3-day free trial. This will allow potential users to experience the platform's capabilities firsthand. After that, it's only $50 MONTHLY.

This entry-level plan includes access to the most unique features that make bookeeping.ai one of the best QuickBooks alternatives.

The sign-up process is user-friendly and quick: visit the bookeeping.ai website, select your preferred plan, and follow the simple registration steps. Once registered, you can start connecting your financial accounts and exploring. Happy chatting with your books!

Don't miss out on this new tool – sign up now to be among the first to experience the future of AI bookkeeping.