In this article, we review three of the best AI Invoice Tools for small businesses, freelancers, and individuals to use and optimize their time and expenses on administration.

Once you start making sales, you need further operations, for example, invoicing; therefore, business expenses increase proportionally to your growth. This is where AI invoice tools come to the rescue for small businesses, startups, and freelancers.

What is an AI Invoice Tool?

AI Invoice Tools are software applications that use artificial intelligence and machine learning algorithms to automate and simplify the invoicing process.

⚠️ An invoice is an itemized commercial document that records the products or services delivered to the customer, the total amount due, and the preferred payment method (Zoho).

AI tools can generate invoices, track payments, send reminders, create documentation for you, and more. They reduce manual data entry and automate repetitive tasks. AI invoice tools help businesses invoice faster, more accurately, and with less effort.

Why use an AI Invoice Tool?

1. Time-saving: Automating invoice creation and sending can save weekly hours.

2. Improved accuracy: AI diminishes human error in calculations and data entry.

3. Faster payments: Automated reminders and easy payment options can improve cash flow.

4. Data insights: AI can analyze invoicing data to provide valuable business insights.

5. Scalability for your projects: As your business grows, AI tools can handle increased invoicing volume without additional staff.

Now, let's start with our top 3 picks for AI Invoice Tools in 2025.

1. bookeeping.ai

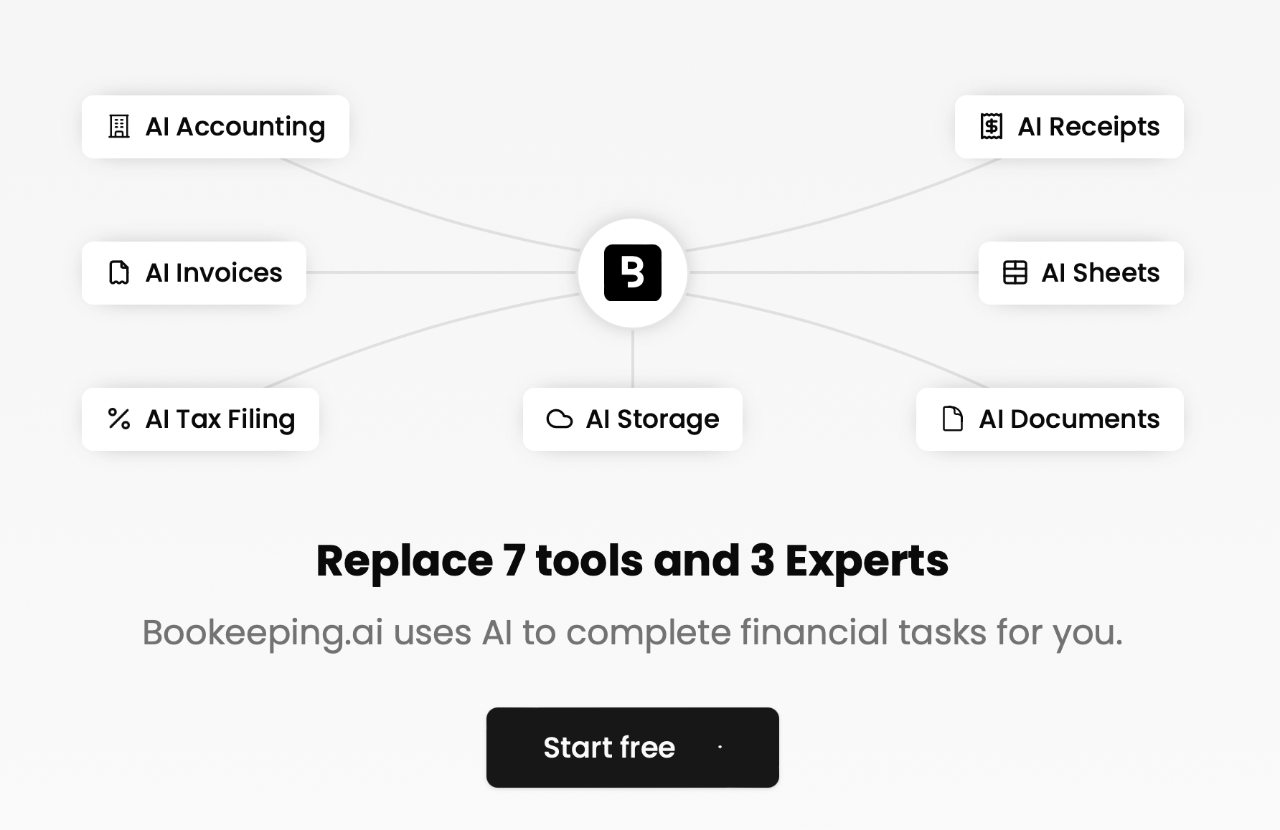

bookeeping.ai is an AI tool that automates 95% of accounting tasks to save you 57 monthly including financial record-keeping, expense managing, and income tracking. This top AI invoicing software has powerful invoicing capabilities.

How you can use bookeeping.ai for invoices:

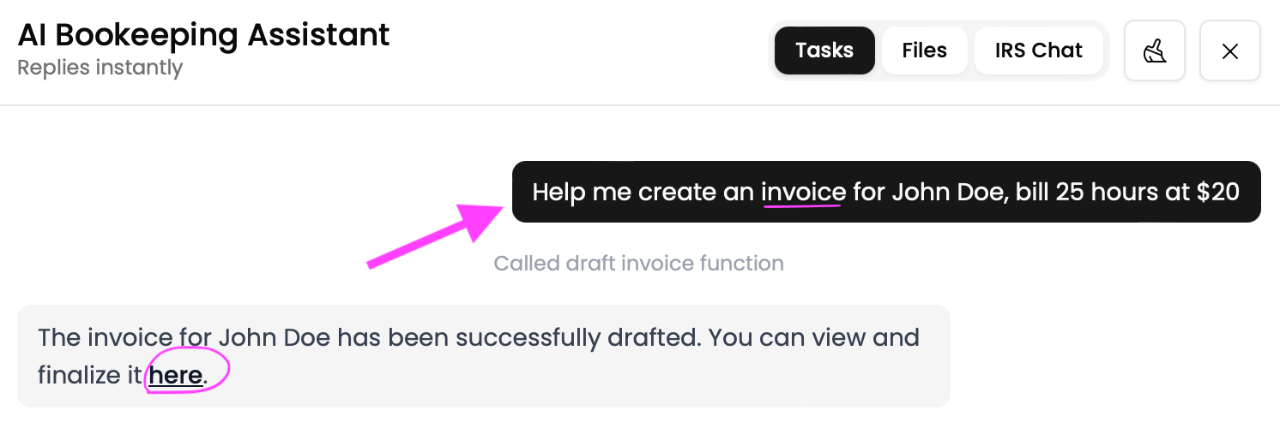

- AI invoice generation from chat commands. Yes! You can ask bookeeping.ai to generate an invoice for you by simply asking:

- Automatic sending of invoices via email. Share an email address to send your invoices without opening your email processor.

- Integration with other financial tasks. Prepare ledger preparation and scan receipts.

- Real-time accounting advice. Improve invoicing strategies with highly personalized advice.

- AI financial insights to optimize cash flow. Get reminders for your invoices to speed up money flow.

- Customizable invoice templates to match your brand. Add your logo and your business details.

Other Features:

- Automated preparation of general ledger, financial profit and loss, and balance sheet using AI

- AutoScan receipts and invoices for categorization from inbox email or mobile app picture OCR

- Real-time accounting and advice to grow your business

- Chat to generate company financial tasks like creating invoices, crafting statements, and sending emails

- AI Spreadsheet generation for your business including assets, liability, and equity

- AI Tax Form filling in the click of a button

- TaxChat reads tax websites like the IRS and HMRC, so you find information in seconds

Complexity: Easy

Free Account: Request a 3-day free trial at https://bookeeping.ai

User Interface Friendliness: 🟢🟢🟢🟢🟢

Rating by Our Team: ⭐️⭐️⭐️⭐️⭐️

bookeeping.ai stands out for its approach to financial management, with invoicing integrated into a suite of AI accounting tools. Its chat-based interface makes it incredibly user-friendly, allowing users to generate invoices and perform other financial tasks with simple text commands. The AI's ability to provide real-time accounting advice is of value for small businesses and freelancers without a dedicated accounting staff.

2. Wave

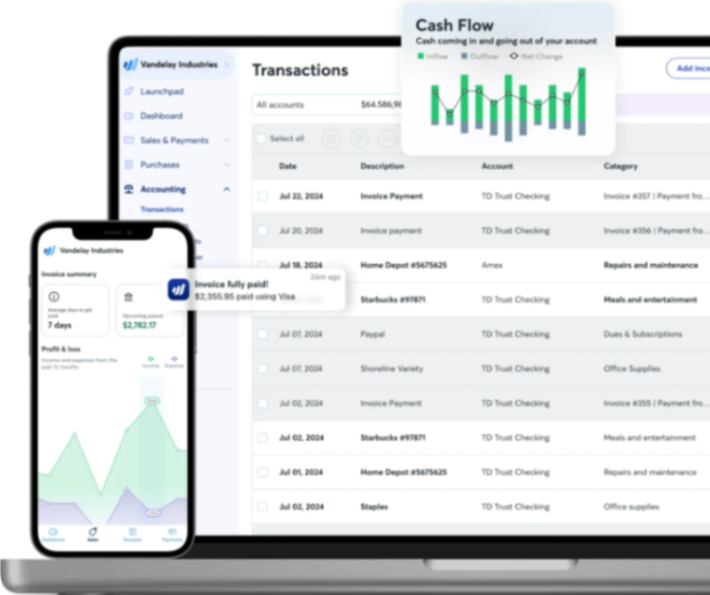

Wave offers invoice software for small businesses as part of its accounting software. It is an attractive option if you would like to access all customer information in one place and personalize multiple invoice templates.

Features

- Creating professional invoices with easy templates

- Unlimited billable customers at no additional cost

- Credit card payments to get paid faster and stop chasing customers with auto-reminders

- Send invoices with Wave’s free app for iOS and Android

- Customers can click a Pay Now button on invoices and pay by credit card, secure bank payment (ACH/EFT), or Apple Pay

Complexity: Low

Free Account: Yes

User Interface Friendliness: 🟢🟢🟢🟢⚪️

Rating by Our Team: ⭐️⭐️⭐️⭐️

Wave assists in creating professional invoices and categorizing transactions, making it a great choice for small businesses and startups.

3. QuickBooks Online

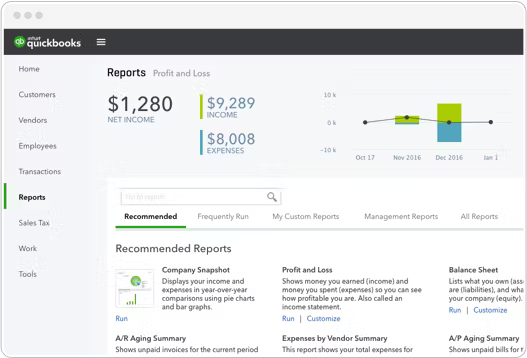

QuickBooks Online has incorporated AI to improve its invoicing capabilities within its accounting platform. It can be used by accountants or small businesses.

Features:

- AI-powered invoice customization and sending

- Automated matching of payments to invoices

- Predictive analytics for cash flow

- Integration with other QuickBooks features

- Extensive third-party app integrations

- Automatic bank and credit card feeds

- Tax category suggestions for expenses

- Invoice tracking from sent to paid

- Mobile app with invoice scanning capabilities

Complexity: Medium to High

Free Account: No, but offers a 30-day free trial

User Interface Friendliness: 🟢🟢🟢⚪️⚪️

Rating by Our Team: ⭐️⭐️⭐️⭐️

QuickBooks Online's AI capabilities extend beyond invoicing, offering predictive analytics and intelligent automation across its platform. It's ideal for businesses that need a full-featured accounting solution with advanced invoicing capabilities.

What is the Best AI Invoice Tool?

Choosing the best AI invoice tool depends on your business needs, budget, and desired level of integration with other financial processes. Here's a quick comparison:

1. bookeeping.ai: Best for comprehensive AI financial management with strong invoicing capabilities. Ideal for businesses looking for an all-in-one solution that goes beyond just invoicing.

2. Wave: Perfect for small businesses wanting, invoicing with basic accounting features.

3. QuickBooks Online: Suited for businesses needing AI invoicing as part of a larger, more complex accounting ecosystem, particularly those requiring advanced reporting and tax features.

When choosing an AI invoice tool, consider the following factors:

- The scale of your business: Larger businesses might need more advanced features and integrations.

- Industry-specific needs: Some tools might be better suited for certain industries.

- Growth plans: Choose a tool that can scale with your business.

- Ease of use: Consider the learning curve and whether you need training.

- Integration capabilities: Ensure the tool can work with your existing systems.

As AI changes business processes, adding these automated invoicing tools can significantly simplify your invoicing workflow, so you focus on growing your business rather than chasing payments. The right AI invoice tool will save you time and provide valuable insights into your cash flow and customer payment behaviors.

Do you want to check more AI tools like these? Check out Dang! here.

We hope this list helps you evaluate the features, pricing, and suitability of AI Invoice tools for your business. Remember, the right tool can save you time, reduce errors, and improve your cash flow - all key factors for business success in 2025 and beyond.

So why wait? Start exploring these AI invoice tools today and take the first step towards having more free time.