In this entry, we explain the difference between AI tools such as bookeeping.ai and traditional bookkeeping methods. You can learn more about the uses, cons, and distinctions and discover the best for your business needs.

You may be hearing about all these AI tools and how you can improve your business, so you wonder: "Should I jump into the AI trend?" It can be completely worth it for repetitive, stressful, and dull tasks like bookkeeping and accountancy.

Bookkeeping is a key function that has undergone important changes over the years. AI in financial management has questioned traditional bookkeeping methods that have been the spine of business accounting for decades.

What is bookkeeping?

Let's start with the basics. Bookkeeping, at its core, is the process of recording, organizing, and managing a company's financial transactions.

It's fundamental for running a business, providing the data necessary for making informed financial decisions, preparing tax returns, and maintaining overall fiscal health.

Historically, this process has been manual, relying heavily on human input and expertise. However, AI tech has introduced new possibilities for automating and optimizing these crucial tasks. 😍

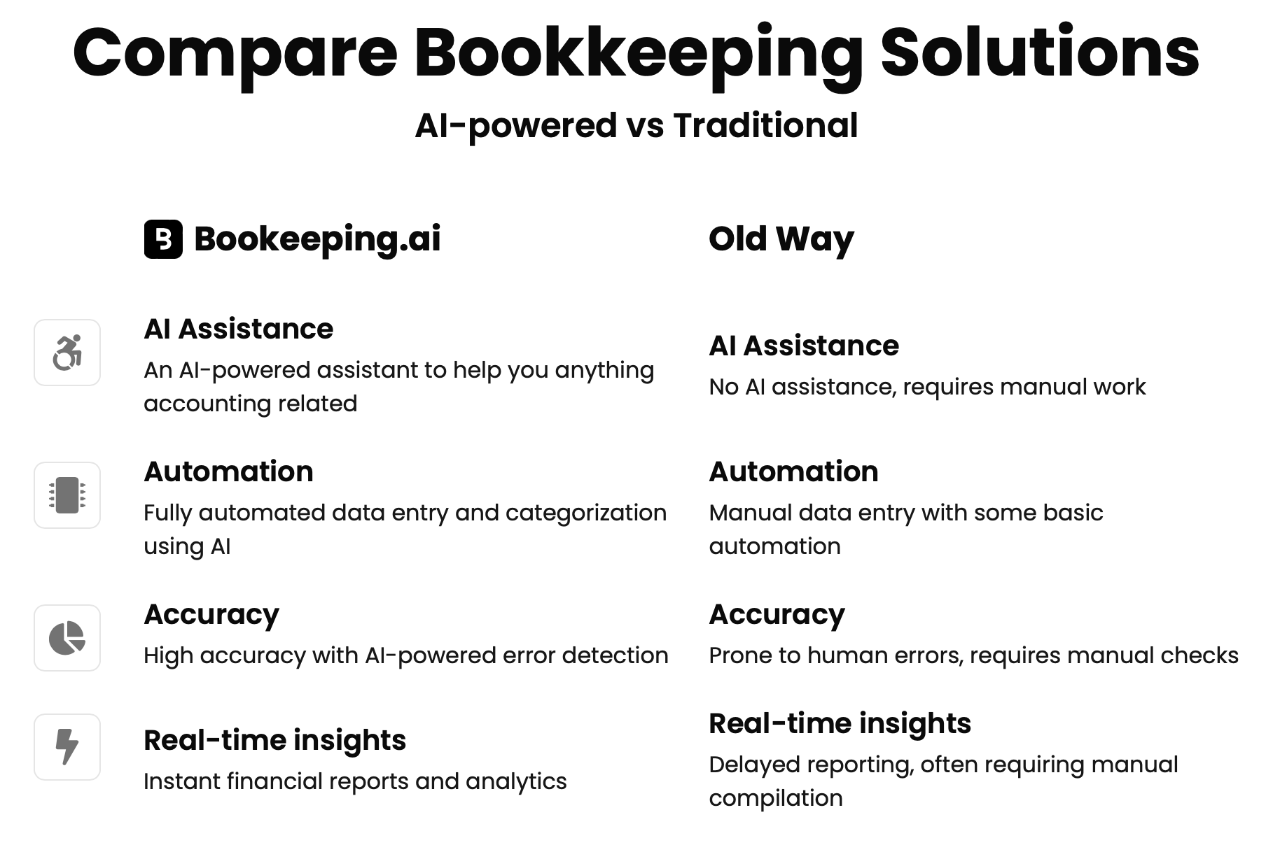

We'll explore the strengths and limitations of both approaches, examining factors such as cost, accuracy, efficiency, scalability, and data insights.

What is traditional bookkeeping?

Traditional bookkeeping has been the cornerstone of financial record-keeping for centuries. It concerns the periodic recording, organizing, and tracking of financial transactions within an organization. This method has stood the test of time, growing from manual registers to computerized systems but still relying significantly on human input and expertise.

Basic components of traditional bookkeeping

- Data Entry: Manually inputting financial transactions into a ledger or accounting software.

- Classification: Categorizing transactions into appropriate accounts (e.g., revenue, expenses, assets, liabilities).

- Reconciliation: Comparing and matching financial records with bank statements to ensure accuracy.

- Financial Statement Preparation: Creating balance sheets, income, and cash flow statements.

- Tax Compliance: Providing all financial records are maintained by tax laws and regulations.

Pros of doing bookkeeping the traditional way

- Human Oversight: Experienced bookkeepers can catch subtle errors and irregularities that might slip past automated bookkeeping tools, though, it may be more common the other way around.

- Customization: Traditional methods can adapt to the specific needs of a business, especially those with unique or complex financial structures.

- Personal Relationship: Having a dedicated bookkeeper or accounting team allows for direct communication and personalized service.

- Established Practices: Well-established procedures and best practices have been refined over many years for the niche as a whole.

Challenges of traditional bookkeeping

- Time-Consuming: Manual data entry and reconciliation can be slow and labor-intensive.

- Prone to Human Error: Even the most diligent bookkeepers can make mistakes, especially when dealing with large volumes of data.

- Delayed Reporting: Real-time financial insights are often not possible due to the time required for manual processing.

- Scalability Issues: As a business grows, traditional bookkeeping methods may struggle to keep up with expanded transaction volumes. More money, more problems.

- Higher Long-term Costs: Salaries, benefits, and ongoing training for bookkeeping staff can be significant, especially for larger organizations.

While traditional bookkeeping has served businesses well for many years, the increasing complexity of financial transactions, growing data volumes, and the need for real-time insights have led many to explore more advanced solutions.

This is why bookkeeping AI has been on the rise.

What is AI Bookkeeping?

Artificial Intelligence in bookkeeping represents a significant jump forward in financial management tech. AI bookkeeping apps use machine learning algorithms and advanced data processing capabilities to automate and improve various aspects of the bookkeeping process.

🤖 AI bookkeeping refers to using artificial intelligence technologies to perform bookkeeping tasks with minimal human intervention.

These systems go beyond simple automation by incorporating cognitive capabilities that interpret complex financial information, identify trends, and even predict future outcomes.

For example, bookeeping.ai changes the repetitive tasks game for your business. Sign up here.

What can AI Bookkeeping do?

- Automatically generate financial ledger and spreadsheets: AI systems can extract data from various sources (receipts, invoices, bank statements) using optical character recognition (OCR) and natural language processing (NLP) technologies. For example, with bookeeping.ai, you can scan your receipts from your phone into your ledger.

- Intelligent Categorization: Algorithms can automatically classify transactions based on historical data and predefined rules, learning and improving precision over time.

- Automatically create and send invoices: Forget manually generating invoices at the end of every month. You can ask AI to do it and even send the email for you.

- Continuous Reconciliation: AI can perform real-time reconciliation, matching transactions across different accounts and flagging discrepancies instantly.

- Advanced Pattern Recognition: These systems can identify unusual transactions or patterns that might indicate errors or fraudulent activity.

- Compliance Monitoring: AI can stay updated with changing financial regulations and ensure that bookkeeping practices remain compliant.

The implementation of AI in bookkeeping doesn't necessarily mean the complete elimination of human involvement. It often leads to a shift in the role of bookkeepers and accountants. With AI handling recurring tasks, financial professionals can focus on higher-value activities such as financial strategy, complex problem-solving, and providing insights to guide business decisions. All the fun is left for the human team.

Cost analysis of traditional vs. AI bookkeeping

When comparing AI bookkeeping to traditional methods, cost is often a primary consideration for businesses.

Let's break down the cost analysis into three main categories: initial investment, ongoing costs, and human resource costs.

How much money can I save by using AI Bookkeeping?

In this section, we compare what and how much money and time you can save by using an AI accounting software like bookeeping.ai vs. human accountants.

💵 Initial Investment

Traditional Bookkeeping: The initial costs for traditional bookkeeping are generally lower. They may include:

- Basic accounting software licenses

- Computer hardware

- Training for staff

AI Bookkeeping:

- More sophisticated software with AI capabilities

- Potential hardware upgrades to support AI processing

- Most software and apps don't require an initial investment

⏰ Ongoing Costs

Traditional Bookkeeping:

- Regular training for staff to stay updated with new regulations

- Potential outsourcing costs for specialized tasks

AI Bookkeeping:

- Monthly or yearly fees in affordable bundles, with tools like bookeeping.ai.

- Regular software updates (usually included in subscription)

🙋🏻♀️ Human Resource Costs

Traditional Bookkeeping:

- Salaries and benefits for in-house bookkeepers

- Overtime costs during busy periods (e.g., tax season)

- Recruitment and turnover costs

AI Bookkeeping:

- Potentially reduced staff numbers for routine bookkeeping tasks

- Higher salaries for skilled professionals to manage and interpret AI systems

- Ongoing training costs for staff to effectively use AI tools

AI bookkeeping software can lead to significant savings over time. As transaction volumes increase, traditional bookkeeping costs tend to rise linearly (more transactions = more staff needed), whereas AI systems can often handle increased volumes with minimal additional cost.

For example, a medium-sized business processing 1000 transactions per month might need two full-time bookkeepers using traditional methods.

With an AI system, the same volume could potentially be handled by one part-time professional overseeing the AI processes.

It's important to note that cost savings can vary greatly depending on the size and complexity of the business.

How much time can I save by using AI Bookkeeping?

Speed of Data Entry and Processing

Traditional Bookkeeping:

- Manual data entry is time-consuming and labor-intensive

- Processing large volumes of transactions can take days or weeks

- Reconciliation processes are often done periodically (e.g., monthly)

AI Bookkeeping:

- Automated data capture and entry (e.g., using OCR for receipts and invoices)

- Can process thousands of transactions in minutes

- Continuous, real-time reconciliation

Case Example:

Consider a retail business processing 500 transactions daily. With traditional methods, it might take a full-time bookkeeper several days to enter, categorize, and reconcile a week's worth of transactions. An AI system could potentially handle the same volume in near real-time, with minimal human intervention.

The time savings provided by AI bookkeeping can be BIG. For instance, a study by Gartner predicted that by 2025, AI and emerging technologies will reduce financial departments' operational costs by 30%.

This reduction is largely attributed to increased efficiency and time savings in tasks like data entry, reconciliation, and report generation.

Accuracy and Error: Traditional Bookkeeping vs. AI

Human Error vs. AI Precision

Traditional Bookkeeping:

- Prone to human errors, especially in data entry and calculation

- Fatigue and distraction can lead to mistakes, particularly when dealing with large volumes of data

- Errors may compound over time if not caught early

AI Bookkeeping:

- Minimizes human error in routine tasks

- Consistent performance regardless of data volume or time of day

- Can flag anomalies and potential errors for human review

McKinsey estimates that 42% of finance activities can be fully automated, potentially reducing errors in these areas to near zero.

Unusual transactions or new scenarios may still require human oversight. Additionally, the accuracy of AI depends heavily on the quality of their initial setup and ongoing management.

Traditional bookkeeping methods have served businesses well for many years, and AI systems offer significant advantages in terms of cost efficiency (especially long-term), time savings, and accuracy. Actually, 36% of accountants are already using AI to automate their workflows.

Meeting regulatory requirements

Traditional bookkeeping:

- Manual entry of data to the ledger which increases the risk of mistakes

- Needs constant training in law and tax rules to stay updated and may not be fresh on changes

AI bookkeeping:

- Every transaction and change is automatically logged with timestamps and user information

- Digital records are easily searchable and can be quickly compiled for audit purposes

- AI can generate detailed reports showing how financial data has been processed and categorized

- Automatically update to reflect changes in tax laws and accounting standards

Want to start your bookkeeping AI journey? Start here.

It's important to note that the choice between AI and traditional bookkeeping is not necessarily a binary one. Many businesses are finding success with hybrid models that combine elements of both approaches.

What are you going to choose today?